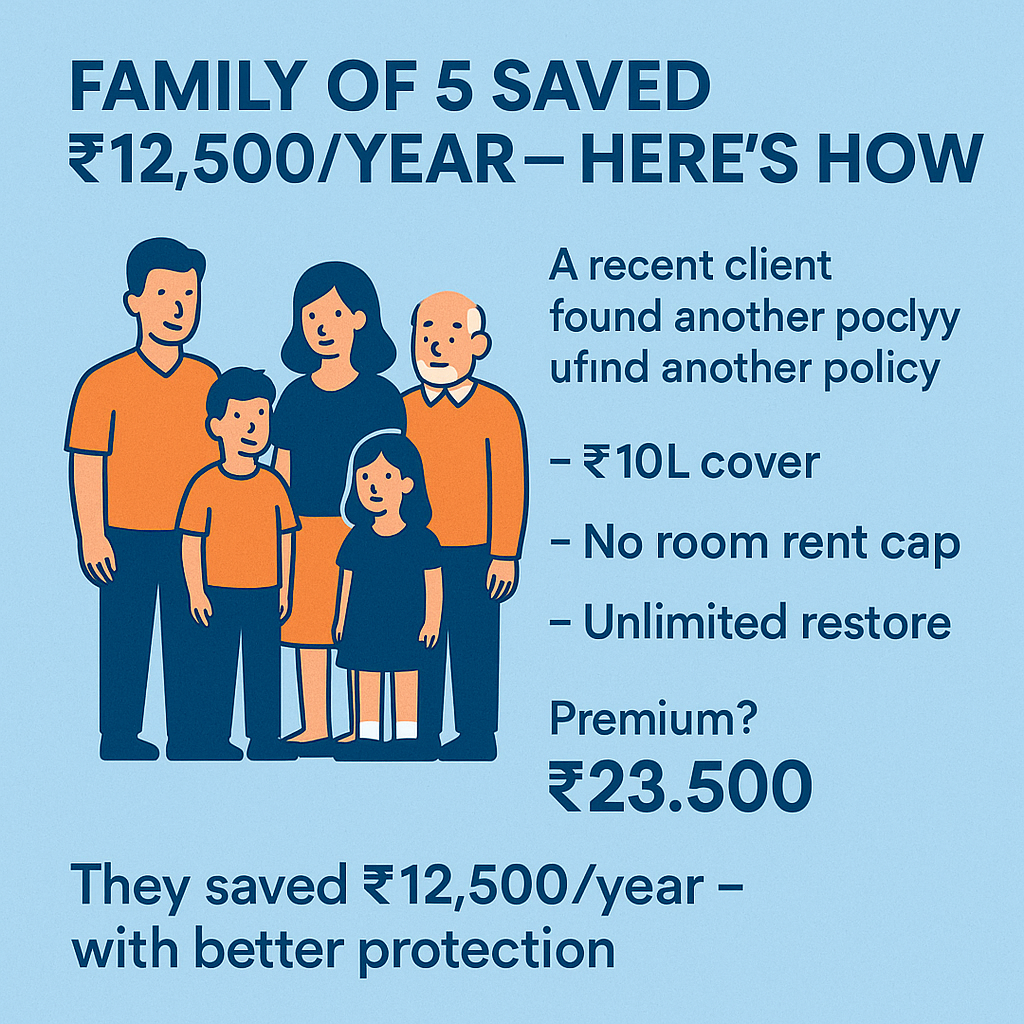

How AI Helped a Family Save ₹12,500 on Health Insurance Without Compromising Coverage

The Misconception That Higher Premiums Mean Better Coverage Many families assume that paying more for health insurance guarantees better protection. While higher premiums often suggest extensive coverage, the truth is not all expensive policies offer the best benefits. Take, for example, a family of five considering a ₹36,000 annual health insurance plan. On the surface, it seemed like a great deal with a ₹10 lakh sum insured, but upon closer inspection, critical gaps were identified: Despite the high premium, the policy had limitations that could lead to substantial out-of-pocket expenses during hospitalization. The Hidden Costs of Suboptimal Insurance Plans Many policyholders don’t realize that fine print clauses can diminish actual claim reimbursements. Let’s break down the specific risks this family would have faced: 1. Room Rent Capping – A Hidden Drain on Finances This policy had a ₹5,000 daily cap on room rent. If a policyholder selected a ₹7,000 per day hospital room, all associated costs—doctor fees, ICU charges, surgery expenses—would be proportionately reduced. This could result in tens of thousands in unexpected expenses. Example of Proportional Deduction Impact Expense Type Actual Cost Insurer’s Revised Coverage (Based on Room Rent Cap) Amount Paid from Pocket Room Rent ₹7,000/day ₹5,000/day ₹2,000/day Surgeon Fees ₹1,00,000 ₹71,400 ₹28,600 ICU Charges ₹25,000 ₹17,850 ₹7,150 Anesthesia ₹10,000 ₹7,140 ₹2,860 Total Out-of-Pocket ₹58,000 — ₹58,000 Even though the family’s policy offered ₹10 lakh coverage, hospitalization could still leave them paying out of pocket due to room rent capping. 2. No Restore Benefit – A Major Risk in Family Policies Family floater plans share the sum insured across all members, but without a restore benefit, one serious illness can deplete the coverage, leaving the rest of the family vulnerable. For example: 3. Disease-Specific Sub-Limits – A Trap for High Treatment Costs Some policies limit reimbursements for expensive procedures. In the family’s original plan: Without understanding these limits, the family could have faced significant financial strain during serious illnesses. Finding a Better Plan Using AI-Driven Insurance Comparison Instead of relying solely on traditional comparisons, the family used AI-powered insurance analysis tools, which helped them identify a policy that: How AI Helps Families Select Smarter Policies Final Thoughts: How AI Helped a Family Save ₹12,500 While Enhancing Coverage By switching to a more transparent policy, the family not only saved ₹12,500 annually but also secured better hospitalization benefits. The new plan ensured: Choosing the right health insurance isn’t just about premium costs—it’s about full financial protection. AI-driven comparison tools make it possible to find better coverage at lower costs, ensuring families maximize their health benefits without unnecessary expenses.

How AI Helped a Family Save ₹12,500 on Health Insurance Without Compromising Coverage Read More »