Health insurance is meant to safeguard financial stability in times of medical emergencies. Yet, many policyholders find themselves burdened with unexpected expenses despite having insurance coverage. The culprit? Low-premium health insurance plans that seem affordable on the surface but conceal crucial limitations.

While these plans promise to lighten your financial load through seemingly attractive premiums, they often mask the real cost of healthcare—forcing policyholders to pay substantial out-of-pocket expenses when making claims.

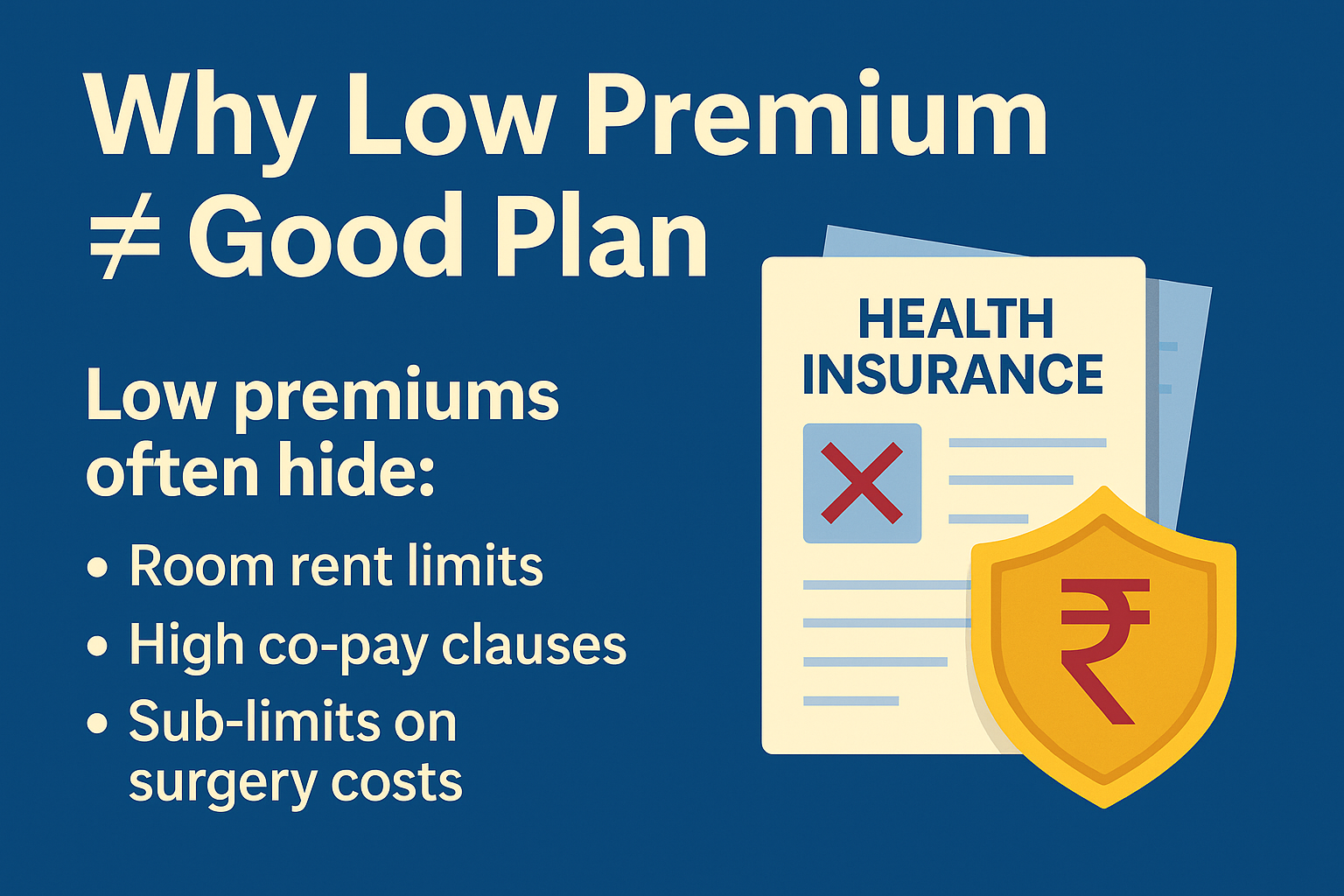

When Low Premiums Hide Inadequate Coverage

At first glance, low-premium health insurance policies appear to be a great deal. After all, who wouldn’t want to pay less while still enjoying health coverage? The issue, however, lies in the fine print.

Many insurers design budget-friendly plans with built-in limitations that significantly restrict coverage. Some common constraints include:

- Room Rent Caps: Many low-premium policies impose a ceiling on hospital room rent. If the limit is ₹3,000 per day but you require a room costing ₹6,000, you’ll have to bear the difference yourself. This also impacts related charges, such as doctor consultation fees and medical procedures, which often vary based on room type.

- High Co-Payments: A co-payment clause requires the insured to pay a fixed percentage of the hospital bill. If your policy includes a 20% co-pay, and your total hospital bill is ₹5 lakh, you’ll need to shell out ₹1 lakh from your pocket—a severe financial strain during an emergency.

- Sub-Limits on Specific Treatments: Certain treatments, including surgeries, organ transplants, and critical illnesses, may have sub-limits. For instance, a plan may offer ₹5 lakh coverage but restrict cardiac surgery expenses to just ₹2 lakh, leaving you responsible for the remaining amount.

- Exclusions and Waiting Periods: Budget plans often exclude key medical conditions or impose extended waiting periods for pre-existing diseases. This means essential treatments might not be covered when you need them the most.

These hidden pitfalls leave policyholders financially vulnerable—precisely when they were counting on their insurance to provide security.

The Real-World Consequences of Low-Premium Plans

Let’s examine a case study that highlights the true cost of inadequate coverage.

Case Study: A Bitter Experience with Low-Premium Insurance

In 2023, Mumbai-based IT professional Ravi opted for a low-cost health insurance plan with a ₹5 lakh cover. Given his good health at the time, he believed he wouldn’t need extensive hospitalization and settled for a policy with a ₹2,500 room rent cap and a 20% co-payment clause.

Everything seemed fine—until Ravi was diagnosed with acute appendicitis and required urgent surgery. His hospital stay lasted five days, and the total bill came to ₹3.5 lakh.

Here’s how his plan left him with heavy out-of-pocket expenses:

- Room Rent Difference: His hospital charged ₹4,500 per day for the room, exceeding his policy’s ₹2,500 limit. He had to pay the ₹2,000 difference per day for five days—₹10,000 from his pocket.

- Co-Payment: His policy included a 20% co-payment, meaning Ravi had to pay ₹70,000 out of the ₹3.5 lakh bill.

- Surgical Cap: His policy capped appendectomy surgery at ₹50,000, whereas his hospital charged ₹75,000, forcing Ravi to cover the ₹25,000 shortfall.

Total additional cost Ravi paid: ₹1,05,000—a massive unexpected expense despite holding a ₹5 lakh policy.

This case reflects a common story among policyholders who don’t scrutinize coverage limitations before purchasing a plan.

Using AI to Assess the True Value of Your Health Policy

With advancements in technology, AI-powered tools can now analyze insurance policies to identify hidden gaps and assess true coverage value beyond just premium costs.

Here’s how AI can help:

1. Smart Policy Comparisons

AI algorithms can compare multiple policies side by side, factoring in room rent limits, co-payment clauses, sub-limits, and exclusions—helping users understand potential financial liabilities.

2. Real-Time Claim Simulation

AI-driven simulations allow users to calculate actual out-of-pocket expenses based on medical scenarios. Users can input medical conditions and receive an estimated breakdown of how much their policy would cover and how much they’d need to pay from their own pocket.

3. Custom Recommendations

AI-powered systems consider users’ health risks, age, income, and medical history to suggest optimal insurance plans without hidden constraints—helping users make an informed decision.

4. Automated Policy Review

Many policyholders fail to reassess their insurance plan over time. AI tools can automatically review existing policies and alert users about potential gaps in coverage as their healthcare needs evolve.

By leveraging AI, individuals can bypass misleading marketing tactics and focus on what really matters: comprehensive financial security during medical emergencies.

Final Thoughts: Prioritizing Coverage Over Premiums

Low-premium health insurance policies may seem appealing at first glance, but hidden limitations can lead to overwhelming financial burdens when making claims.

Instead of focusing solely on affordability, policyholders must prioritize comprehensive coverage—even if it means paying a slightly higher premium.

By using AI-powered tools to assess policy details, individuals can make informed choices that provide real protection, ensuring that their insurance plan stands strong when they need it the most.

When it comes to health insurance, it’s not just about paying less—it’s about securing real financial safety.